Many were taken aback when the latest GOP tax plan didn’t keep the adoption tax credit, and several prominent voices spoke out against the move. Their words appear to have been taken to heart, as the GOP has reversed course and added the adoption tax credit back into both the House and Senate GOP tax bills.

According to The Hill:

A tax credit for adoptive families has been retained in both the House and Senate GOP tax bills, following pushback from socially conservative lawmakers and anti-abortion groups.

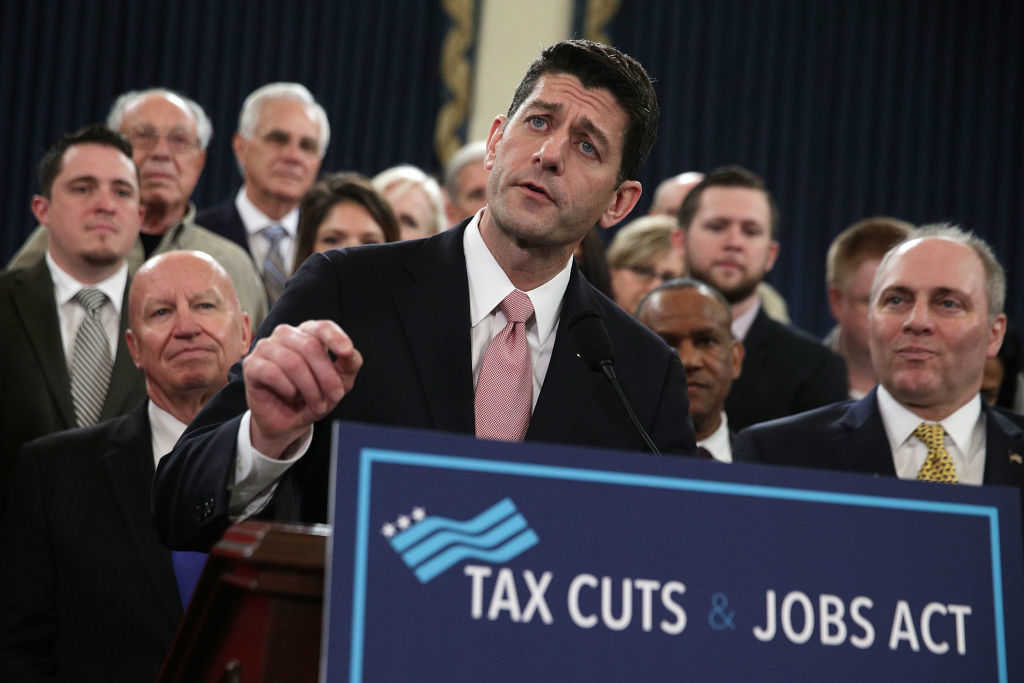

The credit was initially removed in the House version of the legislation, but an amendment released Thursday from Ways and Means Committee Chairman Kevin Brady (R-Texas) retained it.

Preserving the credit “will ensure that parents can continue to receive additional tax relief as they open their hearts and their homes to an adopted child,” Brady said Thursday during the fourth day of the committee markup.

The Senate legislation also preserves the credit, Sen. John Hoeven (R-N.D.) said. The bill is set to be unveiled Thursday.

Religious groups, as well as House and Senate conservatives, pushed for the credit to be retained. They argued that by eliminating the credit, the bill went against the GOP’s anti-abortion platform.

The credit provides up to $13,570 in tax savings per adopted child. Keeping the credit will cost $3.8 billion over ten years, according to the Joint Committee on Taxation.

Reaction to the move seems to be favorable in general, while some wonder how it was allowed to be revoked in the first place.

Here’s the background on the whole story:

Last week, House Republicans unveiled a 429-page new tax plan called the “Tax Cuts and Jobs Act” that pro-life and adoption advocates were dismayed to find did not include the adoption tax credit that has been on the books for some two decades. The abolishment of the credit has united members of the left and right, with many arguing the cut would be detrimental to the future of American adoptions. The omission comes on the heels of President Donald Trump declaring November National Adoption Month.

READ: President Trump’s Powerful Statement Declaring November National Adoption Month

As the Washington Times reported, the the tax break, which started in 1997 with a $5,000 maximum value was set to adjust for inflation and phase out once households hit about $200,000 in adjusted gross income. The maximum credit amount for 2017 has risen to $13,570. While lawmakers have argued the credit primarily benefits wealthier families, who itemize their deductions on their tax returns, adoption advocates believe the opposite—saying the credit makes adoption possible for those who otherwise may not be able to afford it.

Representative Kevin Brady (R-TX), the chairman of the House Ways and Means Committee and architect of the Republican tax plan, is himself the father of two adopted children. A spokeswoman for the committee confirmed to CNN that the congressman never took advantage of the adoption tax credit, and he does not believe its elimination will have any significant impact.

Brady, a Republican from Texas, argues that the tax credit leaves families behind, especially those that don’t itemize or face big tax bills. Instead, he and other bill proponents point to how the reform would nearly double the standard deduction individuals and families can take. It also creates the Family Credit, which includes a new $300 credit for each for parent and non-child dependents, and expands the child tax credit from the current $1,000 to $1,600.

“I’m convinced that if we give tax relief to families every year — they can use their paychecks for what matters most to them — including adopting children,” he said in a written statement to CNN. “We are working to give families not only help when they’re adopting but every year when that child is growing up, by making sure they have more in their paychecks to raise kids.”

But others, including members of Brady’s own party, are not so sure. Congressman Mike Kelly (R-PA) supports restoring the credit and says it should not be a partisan issue.

“This is so critical to who we are as a people,” he told the Washington Times.

According to CNN, the average cost of a domestic newborn adoption was $37,000 in 2015 and 2016 compared to $42,000 for an international adoption, making the process a significant expense regardless of income.

“Financial incentives do make a difference in people’s decisions on whether to adopt,” Adam Pertman, president and founder of the National Center on Adoption and Permanency, told CNN. “Not that they do it for the money, but it’s expensive and it makes a difference and helps people get to yes.”

On Monday, the United States Conference of Catholic Bishops issued a statement calling the credit “life-affirming assistance” and “vital as a pro-life concern,” a sentiment that was echoed by the Southern Baptist Convention’s Russell Moore on Twitter:

It is shameful that the House tax reform plan still includes the removal of the adoption tax credit.

Funding Planned Parenthood, but taxing adopting families.

This is not pro-life, by any definition of the word.

Let’s fix this.

— Russell Moore (@drmoore) November 8, 2017

During his radio show on Wednesday, Jim Daly, president of Focus on the Family, asked listeners to call their elected officials and ask them to preserve the credit.

“Tax relief for families is a worthy goal, and we support that, but not at the expense of orphans and adoptive families,” he said. “Families don’t adopt children in order to get a tax credit, but it’s a great way to help them do it.”