Disruptions in key supply chains throughout the pandemic exposed a serious vulnerability: One of America’s greatest adversaries basically controls the needs of key U.S. industries.

Listen to the latest episode of CBN’s Quick Start podcast 👇

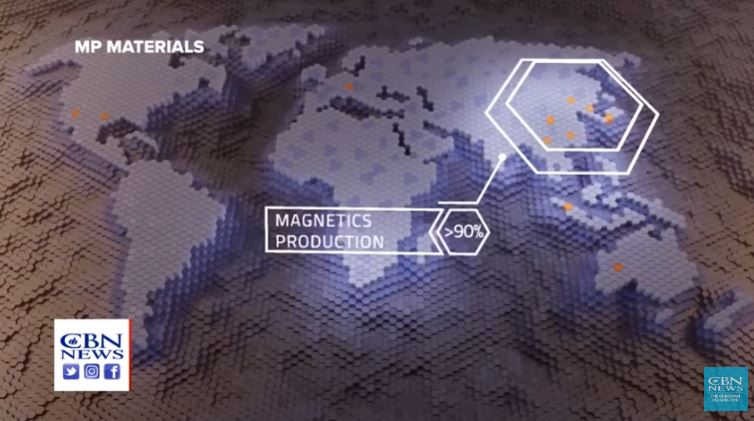

The elements needed for some of the most commonly used technologies in the world today are relatively abundant in the earth’s crust, including here in the United States, but when it comes to the global supply chain, it’s almost entirely controlled by China.

WATCH: CBN’s Caitlin Burke Reports on China’s Rare Earth ‘Cartel’

“China produces about 65 percent of global rare earth mining, some 85 percent of processing, and about 90 percent, or a little bit above that, of the actual magnets that we use in our devices every day,” explained Frank Fannon, CEO of Fannon Global Advisors and former Assistant Secretary of State for Energy Resources.

As the relationship between Beijing and Washington seems to crumble, demand for tech that relies on rare earth elements is only building.

“Rare earth materials are 17 elements on the periodic table. So it’s not just one element, and they’re used for all sorts of applications across modern life. But what they are really essential for in the context of today’s world is they are used to produce the highest strength magnets that power electric motors and generators of all kinds; everything from electric vehicles, to wind turbines, to drones, robots, and some of the most advanced weapons systems that keep us safe for defense applications,” said Matt Sloustcher, Senior Vice President of Communications and Policy at MP Materials.

***Please sign up for CBN Newsletters and download the CBN News app to ensure you keep receiving the latest news from a distinctly Christian perspective.***

Relying on the country seen as the greatest threat to both U.S. prosperity and national security is an obvious problem, and experts believe the solution is even more obvious.

“We were a leading producer of these before, we can do so again,” Fannon told CBN News.

“Early companies in the United States pioneered some of the most cutting edge compounds for rare magnets. However, like many of the strategic supply chains we’re now so focused on on-shoring, beginning in the 1980s and 90s we largely off-shored these industries because the United States decided to specialize in other areas,” Sloustcher explained.

In 2017, the owners of MP Materials bought an abandoned mine in the Mojave Desert. Their goal: use it to create a complete magnetic supply chain. In less than a decade, they’ve almost accomplished it with the Mountain Pass Mine, now the largest rare earth mine in the United States.

“Today, we produce around 15 percent of the global rare earth content. But what we need to bring back to America, and what we are in progress of bringing home, is the ability to refine those materials domestically, and then to produce the metals, alloys, and magnets themselves,” Sloustcher said.

He says the company is moving full steam ahead on the final steps of this supply chain.

“We’re now at the point where we can begin the commissioning of that refining step. Simultaneously, in Texas, what we’ve been doing for the past 18 months is building a team and constructing a factory to produce metals, alloys, and magnets,” Sloustcher told CBN News.

The project has the support of both the public and private sectors. Back in 2021, General Motors agreed to buy the magnets produced for use in their electric vehicles. The Department of Defense is also interested, investing $10 million in 2020, and another $35 million in 2022.

“In order to create energy security in the United States, we need to have commercial scale champions that can feed into our large manufacturers that will provide commercial resiliency, and it will also enable us to ensure that the defense needs are met,” Sloustcher said.

Creating this kind of supply chain here has bipartisan support. Fannon says the Trump administration also backed the project.

“In the case of MP Materials, we were very supportive of some of their work, you know. They actually had a Chinese interest investor who had a significant investment, and we worked with MP and were very supportive of their outreach to other investors to effectively dilute the ownership stake of the Chinese interests, so much so that they exited the board,” said Fannon.

He sees China essentially operating as a cartel when it comes to its control over the rare earth industry. Case in point, recently moving toward banning exports.

“They announced that they intend to withhold, to restrict the export of rare earth element technology to other countries, restrict other countries to be able to basically compete with them in the rare earth space,” Fannon said.

These materials will also play a significant role in the U.S. clean energy transition, with demand expected to triple over the next decade. Fannon says both the federal government and the corporate sector must stop undermining U.S. strength and security by continuing to turn to China for cheap, clean energy goods.

“They’re seeking to create, and are, the dominant supplier to meet the West’s environmental objectives…the Chinese have been using our values against us as a weakness. I believe if we mobilize them, it can be a strength in terms of the marketplace,” Fannon explained.

Fannon says it’s imperative the U.S. fully commit now to building the clean, secure, and resilient supply chains needed in the future, a future that must not rely on China.